7+ loan decisioning

Looking for a secured or personal loan. Utilize one integrated system with application decisioning through boarding tools.

Loans Management Systems Third Pillar

Consumer demand for mortgages in the United States has skyrocketed due to a surge in home buying during the COVID-19 pandemic and as a result of low interest rates that have made refinancing attractive over the past two yearsAlthough a rise in rates would cool refinance activity banks nonbank lenders and mortgage industry investors are likely to.

. Ascents credit decisioning criteria is proprietary and subject to change but you can check what rates you pre-qualify for in just four 4 steps without impacting your credit score. Evaluating a loan for retention workout andor borrower eligibility for a Short Sale and Mortgage Release. You can make transfers or loan payments check balances and more.

Decisions is a leading rules-driven no-code process automation platform with a robust rules engine and thousands of built-in workflow steps. Local decisioning and a variety of mortgage products that will meet your financial goals. Quickly build applications automate manual processes eliminate info silos and make better decisions.

Grow your skills expand your horizons and take part in networking opportunities. Origination generally includes all the steps from taking a loan application up to disbursal of funds or declining the application. Credit card or car finance options with us we use smart decisioning to check your details against our one of many lenders eligibility criteria and find you options that youre eligible for.

Vesta is a SaaS provider of mortgage loan origination software. But not limited to credit score. Weve designed our AI-Powered Data and Decisioning Platform with key data AI and decisioning capabilities to give you the flexibility to iterate expand and scale on your timeline.

Decisioning Creating intelligent consistent and auditable customer facing decisions. A cosigned student loan is a student loan that you take out with the help of a creditworthy person. Freedom Finance compares deals from over 40 leading UK lenders to help you find the right deal.

New 7 and 12-year repayment terms in addition to 5 10 15 and 20-year terms depending on the loan you choose. Our operating hours are Monday to Friday 800am to 700pm Saturday and Sunday 900am to 500pm excluding public holidays. APR as low as.

TurnKey Lenders award-winning loan origination platform is powered by proprietary AI allowing for ever-improving instant loan decisions with superior scoring quality. With an Auto Loan from Meijer Credit Union youre not just getting a new car youre getting peace of mind. What is Online Banking.

My C1CU - Community 1st Credit Union. Learn More About Zoots Instant Decisioning Solution. Automate the process of collecting loan documents from borrowers and emailing loan status updates to real estate agents and borrowers.

August 09 2022 Student Loan Debt Crisis. Technical assistance of about 37 million complemented the lending component and focused on capacity building of SIDBI and the participating financial institutions PFIs. The loan application form scoring and decisioning details schedules terms documents and.

Using Alternative Credit Data for Financial Inclusion Scalable Growth. The platform provides lenders with a modern system of record and customizable workflows for an end-to-end mortgage loan fulfillment process. With Online Banking you can view transactions made on your accounts transfer funds between.

79 of borrowers want their community lender to offer more all-digital solutions. Ascents credit decisioning criteria is proprietary and subject to change but. SMDU streamlines workout decisioning and case reporting to Fannie Mae allowing you to easily make real-time workout decisions with confidence and offer the best solution to struggling homeowners.

Designed for loan originators and mortgage professionals Floify is the industrys leading point-of-sale solution that streamlines the loan process by providing a secure communication and document portal between the lender. Financial inclusion is positioned prominently as an enabler of other developmental goals in the 2030 Sustainable Development Goals where it is featured as a target in eight of the seventeen goals. Introducing innovation in SME finance such as e-lending platforms use of alternative data for credit decisioning e-invoicing e-factoring and supply chain financing.

Download our mobile app and have 247 access to your accounts. For banks and financial institutions rising consumer loan delinquency rates and loan charge-offs are putting debt recovery technology in the spotlight. Online Banking is a FREE service that allows you to access your First PREMIER Bank account information 24 hours a day 7 days a week.

View The Work Number eBook. Maintain loan decisioning documents and the approval chain for credit presentation packages. Consumer credit is one of the many financial services that continues to change since the pandemic making credit risk decisioning and data analytics even more Love 0.

Experts Weigh In During our July 28 Market Pulse webinar our panel of experts discussed what lenders and Gen-Z shoul. The Paycheck Protection Program PPP is a 8135B business loan program established by the United States federal government in 2020 through the Coronavirus Aid. Layering The Work Number database into credit decisioning could enable more than 7 million people to qualify for better offers.

FINPACK is a complete credit management solution that seamlessly integrates loan processes to reduce origination costs improve compliance and speed loan approvals. Loan origination is the process by which a borrower applies for a new loan and a lender processes that application. Available as a cloud-based SaaS solution or installed software.

And does not incorporate any of the background decisioning work required to assess the. Whether you need a proven loan origination solution a servicing back end or an end-to-end system Vergent has the technology to power your lending business. Headquartered in San Francisco CA the company was founded by early Blend employees Mike Yu and Devon Yang in 2020.

700Credit is the largest provider of credit reports compliance solutions and soft pull products to automotive RV marine and powersports dealers. Provenir powers data orchestration and risk decisioning processes across identity credit and fraud to help you get ahead and stay ahead of risk. If you have no credit or bad credit a cosigner with a good credit record may lower the interest rate of your student loan and allow you to choose better terms.

Bad Times Good Credit Becker 2020 Journal Of Money Credit And Banking Wiley Online Library

Manager Credit Risk Resume Samples Velvet Jobs

7 Lessons For Choosing The Best Loan Origination System

Credit Decisioning Actico

Designing Next Generation Credit Decisioning Models Mckinsey

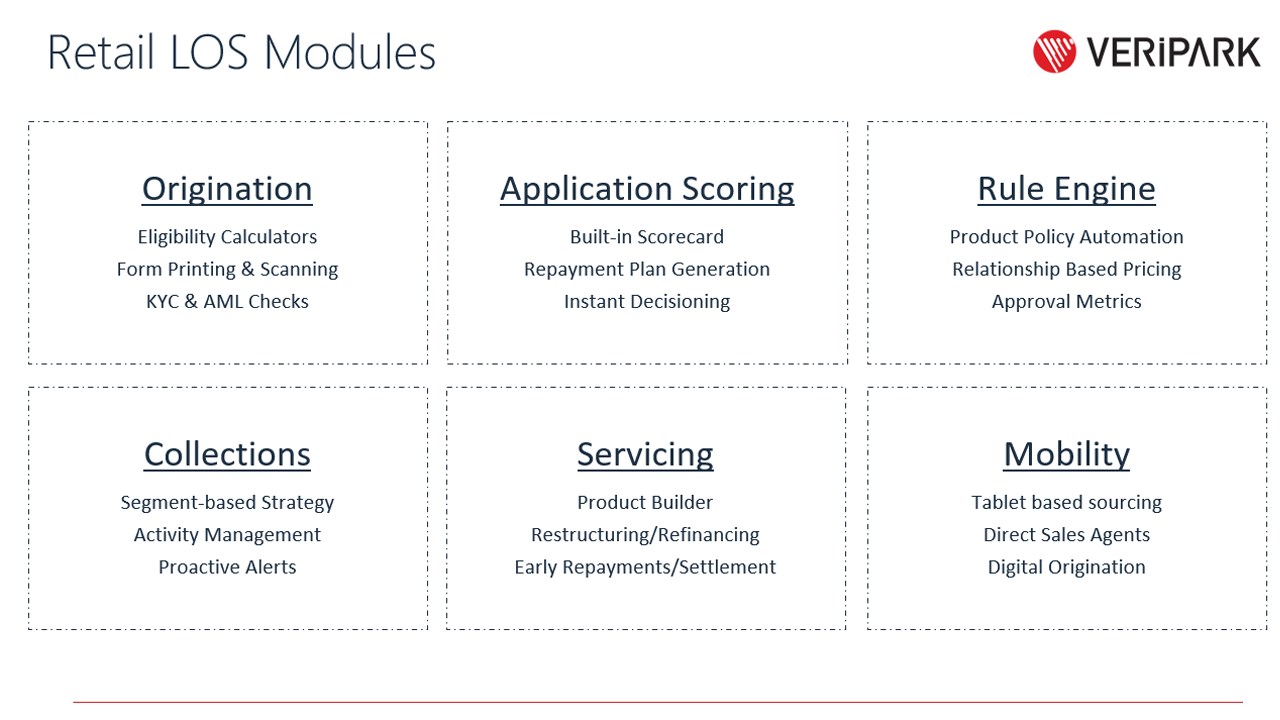

Corporate Loan Origination Veripark

Kaiserslautern American August 19 2022 By Advantipro Gmbh Issuu

Find The Right App Microsoft Appsource

Designing Next Generation Credit Decisioning Models Mckinsey

Fico Origination Manager Decision Service Q A Fico

Pdf Population Based Estimates Of Age And Comorbidity Specific Life Expectancy A First Application In Swedish Males

Loan Management Module Microsoft Dynamics Ax Forum Community Forum

Credit Decisioning As A Service How Does Algoan Leverage Open Banking To Serve The Credit Industry By Youness Bounif Algoan Medium

Data Driven Lending In The Age Of Ai By Winston Robson Future Vision Medium

Financial Planning And Decision Making Ithought Plan S Blog

How Loan Decisioning Works Infinity Enterprise Lending Systems

Improving The Quality Of Credit Decision Stage With Decision Automation